SME Family Office Services

Profit Improvement

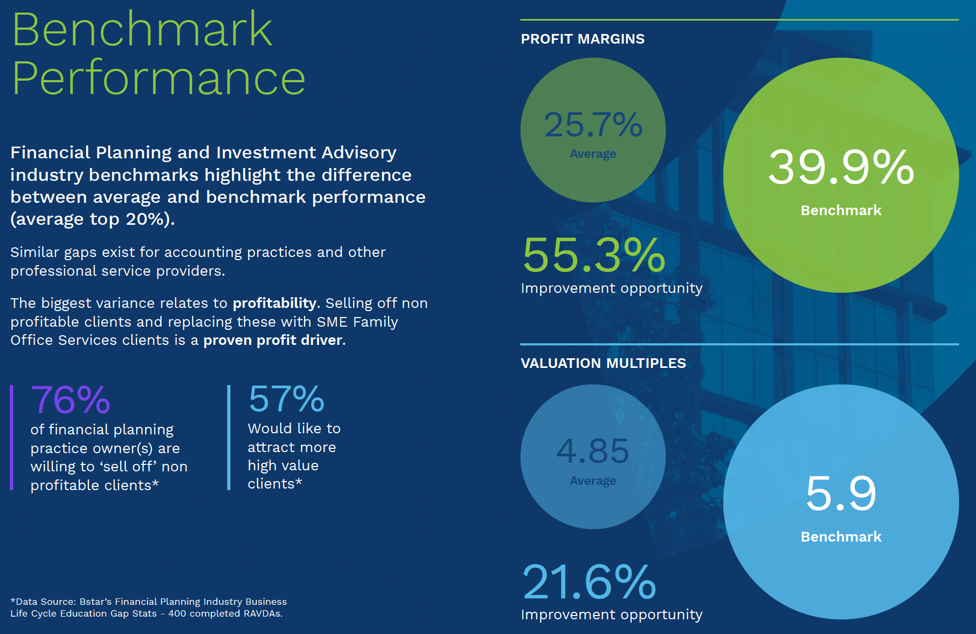

One of the biggest benchmark variances in the financial planning industry is profitability.

To improve profit margins, top performing financial planning practices are establishing service offerings that address complex advice issues and build deeper SME Family Office relationships.

The SME Family Office Services model requires value-adding solutions and complex advice skillsets.

Service Gap

Demand for Family Office Services is high, especially from ideal clients (e.g. business owners, high net worth, time poor professionals – Medical Specialists, GPs, Dentists etc).

However, a service gap exists. Accountants are struggling with tax & compliance workloads. More business owners are asking their financial adviser for succession planning advice & support.

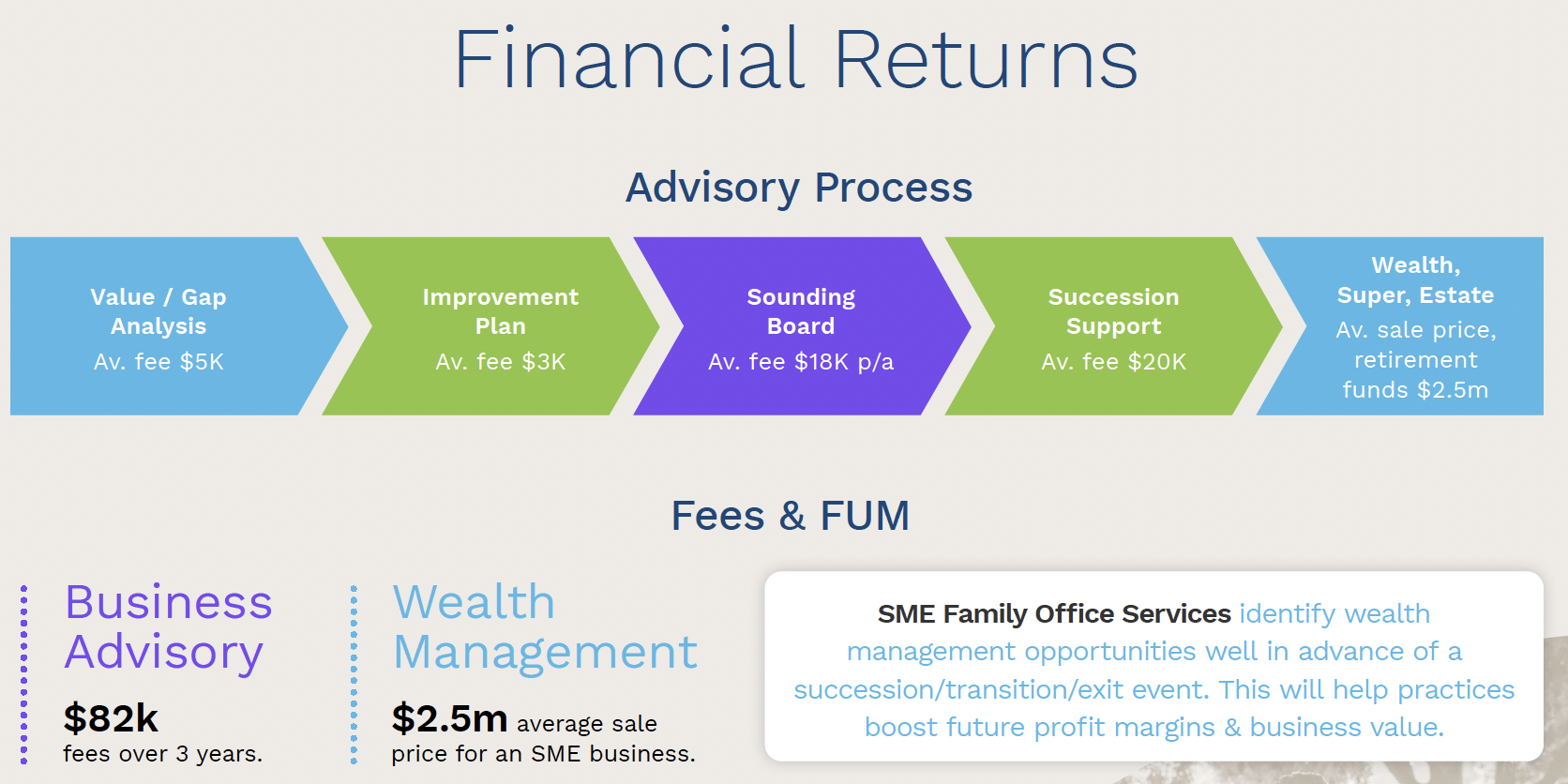

Financial Returns

84% of SME owners are relying on the sale of their business to fund part or all of their retirement.

88% have a value gap risk.

A SME client 3 – 5 years out from succession, sale or exit is an ideal Family Office client.

The diagram below highlights Bstar’s recommended advisory process for this client segment & the financial returns.

To find out more or to request a copy of the Guide to SME Family Office Services click the button below.